The International Accounting Standards Board (IASB) issued a new International Financial Reporting Standards (IFRS) on the recognition and measurement of financial instruments – IFRS 9.

IFRS 9 replaces the existing IAS 39 “Financial Instruments: Recognition and Measurement” from 1 January 2018 and introduces changes in the following four areas:

The new standard nevertheless retains certain principles in IAS 39. For example, the requirements on derecognition of financial assets and liabilities as well as classification and measurement of financial liabilities remain unchanged.

Implementing IFRS 9 won’t be easy. The smooth and successful implementation of IFRS 9 will depend on the type and complexity of the financial instruments held and whether changes to current systems and processes were made.

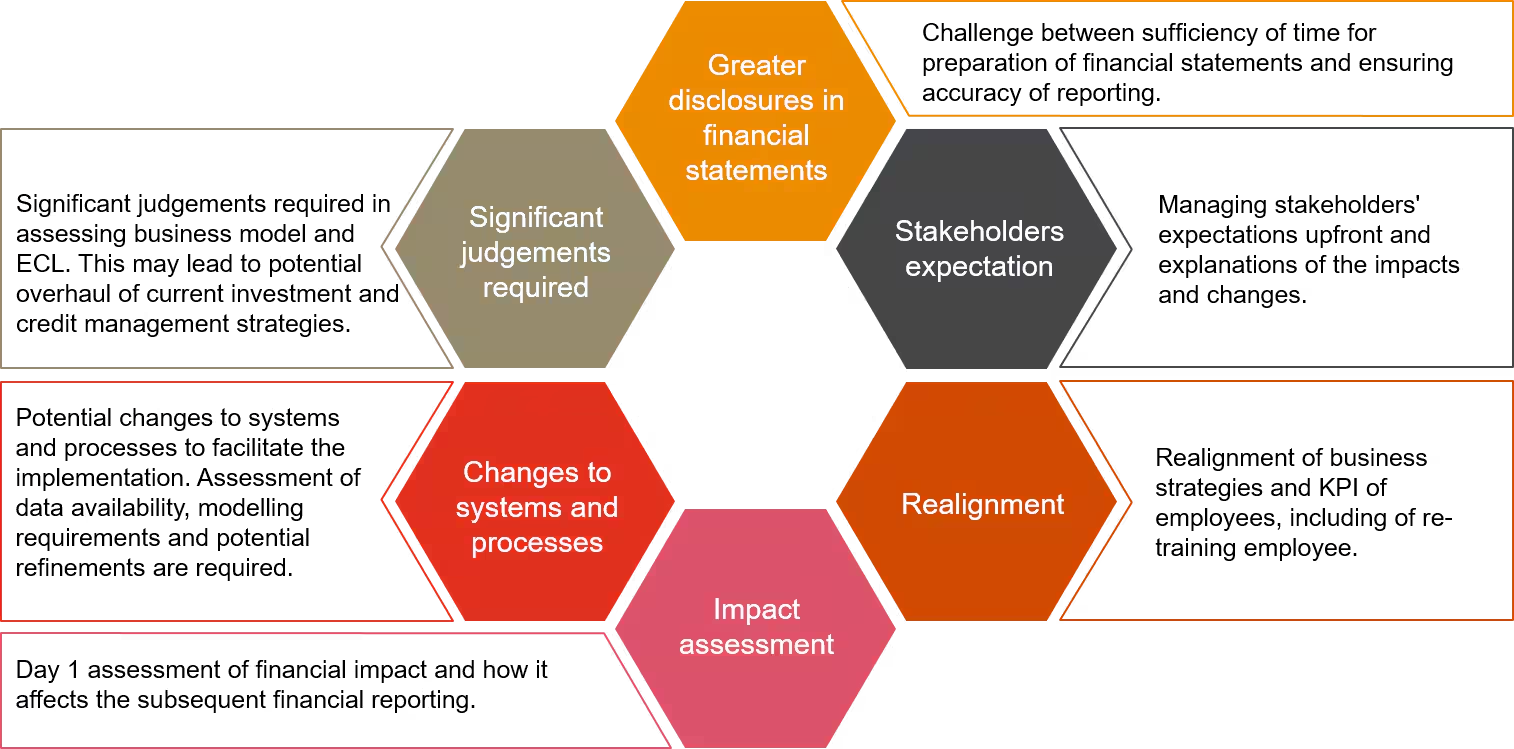

Below are some potential implementation challenges that you could face.

Talk to us to find out how we can help you address some of these challenges.

Want to stay up to date on tax news?

Sign up for news here!

Get in touch