IFRS 16 – Leases is changing effective for annual periods beginning on or after 1 January 2019. Are you ready?

Leasing is an important financial solution used by many organizations. It enables companies to finance property, plant and equipment without the need to incur large initial cash outflows.

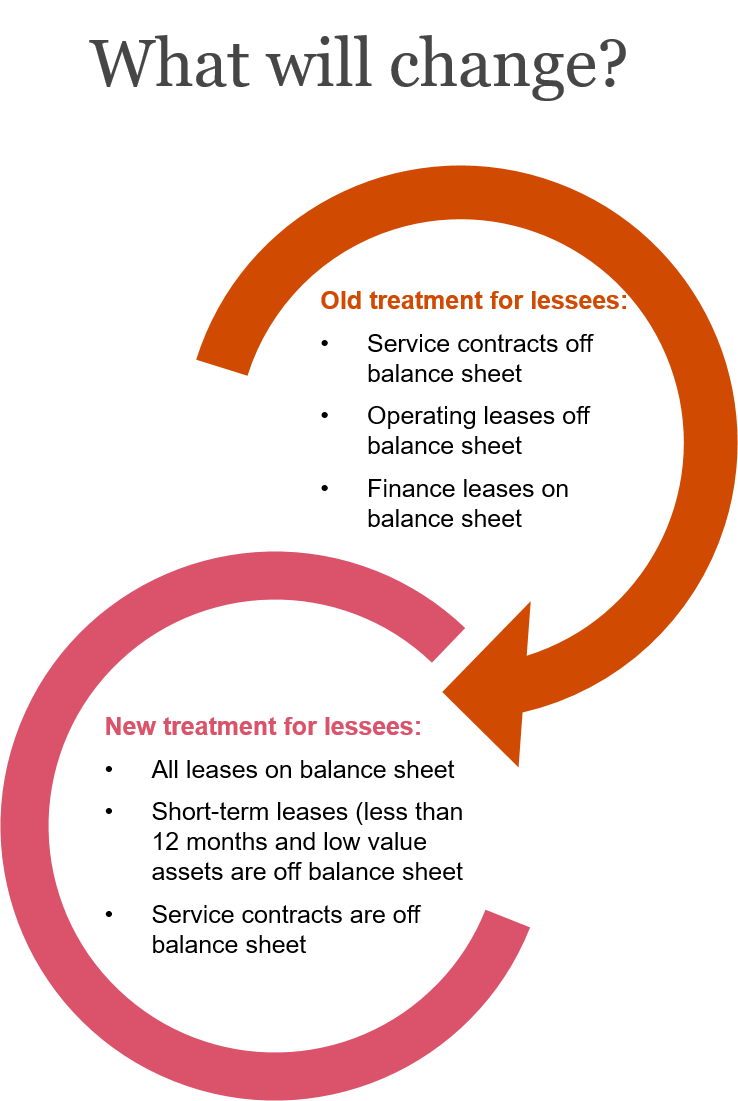

Under the existing leases standard (IAS 17), lessees account for lease transactions either as off-balance sheet operating or as on-balance sheet finance leases. The new standard requires lessees to recognise nearly all leases on the balance sheet.

The accounting change for leases is just the tip of the iceberg. Changes to the lease accounting standard have a far-reaching impact on lessees’ business processes, systems and controls.

Companies will need to take a cross-functional approach to implementation, not just accounting. The new standard will have an impact on your financial ratios and it may impact your financial covenants, credit ratings, borrowing costs and your stakeholders’ perception of you.

Project setup, governance and resources

Scoping, model impact and assess business implications

Implementation – gather and validate data

Want to stay up to date on tax news?

Sign up for news here!

Get in touch