Current uncertainties in the global economy and financial markets are putting unprecedented pressures on companies and their supply chains. With investors and rating agencies feeling increasingly exposed, there has never been a more important time to focus on maximising liquidity and free cash flow.

Based on our experience working with clients to improve their working capital, CEOs, CFOs, Group Finance Directors, Group Treasurers or Shareholders are currently likely to face the following issues:

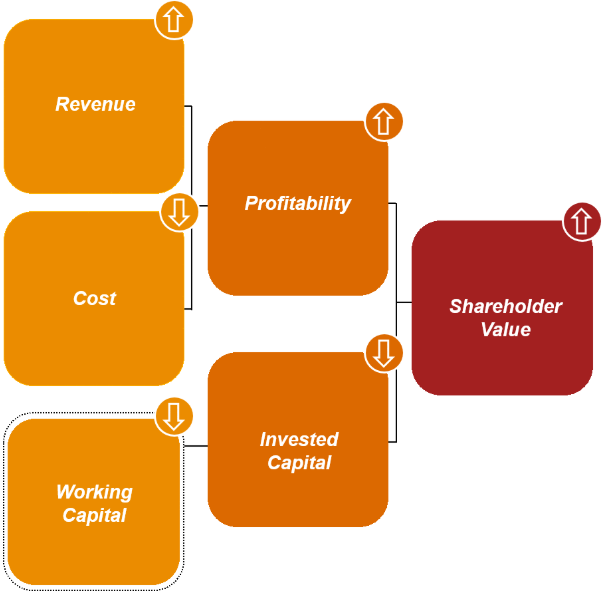

Working Capital Management Programs are a Key Driver of Shareholder Value, and Self-funding

Example:

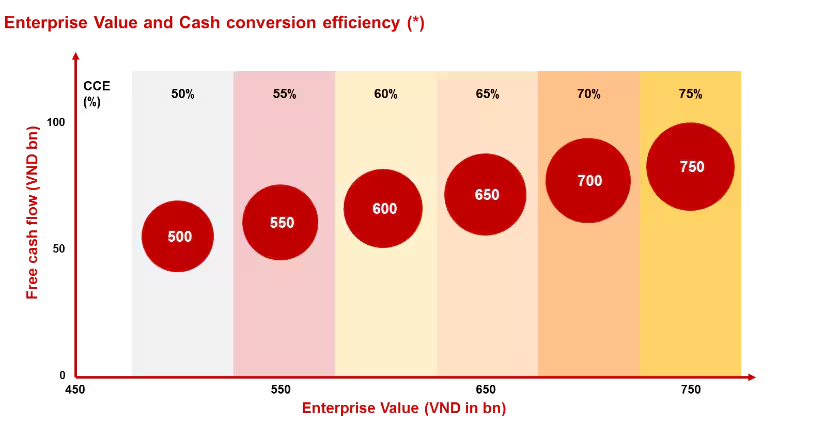

Enterprise Value = free cash flow / (risk less growth)

Assume a company generates VND 55 billion in free cash flow and VND 110 billion in earnings before interest, tax, depreciation and amortization (EBITDA). Risk as measured by the company’s cost of capital is 15%, and based on historical data the future growth rate is expected to be 4% per year.

Using the valuation framework above, the Company‘s Enterprise value (EV) are estimated using different Cash conversion efficiency (CCE) levels in the chart below.

(*) Note: we use the given Cost of capital, and future growth rate, as well as EBITDA for all scenarios

The Company is initially valued at VND 500 billion at 50% CCE, equivalent of 5 times EBITDA. By improving CCE% to 75%, the Company’s value has grown by VND 250 billion to VND 750 billion, equivalent of 7 times EBITDA.

Given that cash is often the most cost-effective source of available funding, senior management are frequently eager to implement WCM strategies. The benefits of successful WCM programs can be fast to materialize, with initial results realized within a three-month timeframe and are sustainable. By optimizing the amount of working capital required, our clients benefit from increased cash availability from the areas of Payables and Procurement, Inventories, Revenue Management, and Accounts Receivables Management. It also helps to streamline service levels, reduce wastage and rework and improve operational control leading to revenue enhancements and cost benefits. WCM programs are therefore self-funding

Large APAC corporates, private equity and distressed companies facing liquidity issues but trying to avoid liquidation. Under an M&A context, our work can be assimilated into both pre-deal and post-deal stages.

A potential client for WCM would be one with the following traits:

Want to stay up to date on tax news?

Sign up for news here!

Get in touch